More than ten years after its introduction in January 2013, banks still struggle to fully adopt the Basel Committee on Banking Supervision’s standard number 239 (BCBS 239). This global standard was created in response to the 2008 financial crisis. Its goal is to improve how banks and financial institutions manage risks and make decisions to better handle and mitigate those risks.

Although the European Central Bank (ECB) considers BCBS 239 compliance a top priority, only 2 out of 31 assessed global systemically important banks (G-SIBs) were deemed fully compliant with all principles, and no single principle has been fully implemented by all banks (PwC, 2023).

Understanding and implementing BCBS 239 is crucial for financial services leaders to maintain regulatory compliance, mitigate risks and promote data-driven decision-making. Failure to comply can result in significant financial penalties, reputational damage and increased scrutiny from regulatory bodies.

Go beyond mere compliance and future-proof your data strategy

Given the challenges banks face in meeting the BCBS 239 principles, a robust data governance framework is crucial for adhering to the regulation’s requirements while offering the opportunity to unlock business value beyond compliance.

In May 2024, the European Central Bank released revised Risk Data Aggregation and Reporting Requirements (RDARR) guidelines. Seven key areas of concern were identified that require greater emphasis on data quality, end-to-end data lineage, robust data controls and a more comprehensive view of risk across the entire organization. The goal is to improve the accuracy and timeliness of risk reporting, enabling more effective risk management and supervision.

However, complying with BCBS 239 benefits financial institutions in ways beyond regulatory adherence. According to Deloitte’s BCBS 239 Benchmark Survey 2024, “Although 68% of banks expect more effective business steering from implementing BCBS 239 principles, only 21% have achieved this so far.”

Eliminate the complexity of BCBS 239 compliance with Collibra’s all-in-one platform

Currently, most tools in the market provide isolated solutions, resulting in fragmented catalog, lineage and data quality capabilities. This increases complexity and creates challenges for integration.

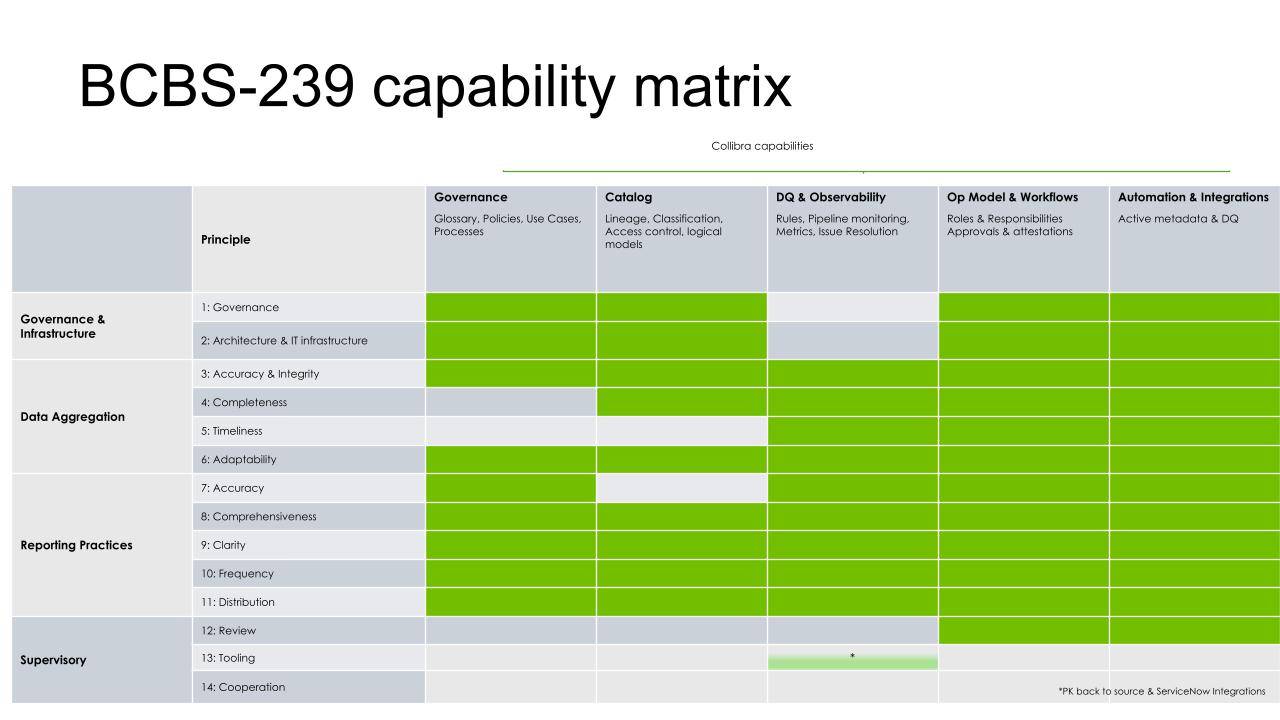

Collibra’s industry-leading Data Intelligence Platform simplifies compliance with BCBS 239 by unifying and automating key enterprise capabilities across catalog, lineage, governance, privacy and data quality. This effectively establishes a control and accountability framework while reducing manual efforts, eliminating the need to stitch together different tools and capabilities.

You can identify and monitor data quality anomalies using AI-generated rules and automatically harvest lineage to provide complete visibility into your organization’s data flows and transformations.

This will provide you with a complete end-to-end view of your critical data assets, helping you understand data context, whether it can be trusted, where it comes from and who owns it.

Collibra provides a comprehensive solution that integrates all regulatory compliance requirements into a single platform rather than offering separate point solutions for each principle.

We’re here to help

Accelerate your BCBS 239 compliance with Collibra’s Professional Services team. With our 4-week BCBS 239 Accelerator, Collibra architects will benchmark your end-user experience, catalog performance, operating model, and metadata processing and provide recommendations for maximizing the success of your BCBS 239 compliance program powered by Collibra.

Talk with the Customer Success team or your Services Manager to learn more.